b. In order to produce output of 2200 in 2001 (given A is constant from

2000 to 2001), the amount of K that is required is determined by the

following equation:

c. The output in 10 years time, assuming productivity remains unchanged,

will be:

d. To show that doubling the inputs K and N will exactly double output, we

multiply each variable by 2 and calculate:

We can see that the production function is homogeneous of degree one because this property is true for any number, i.e. X=2, 3, 100, etc.

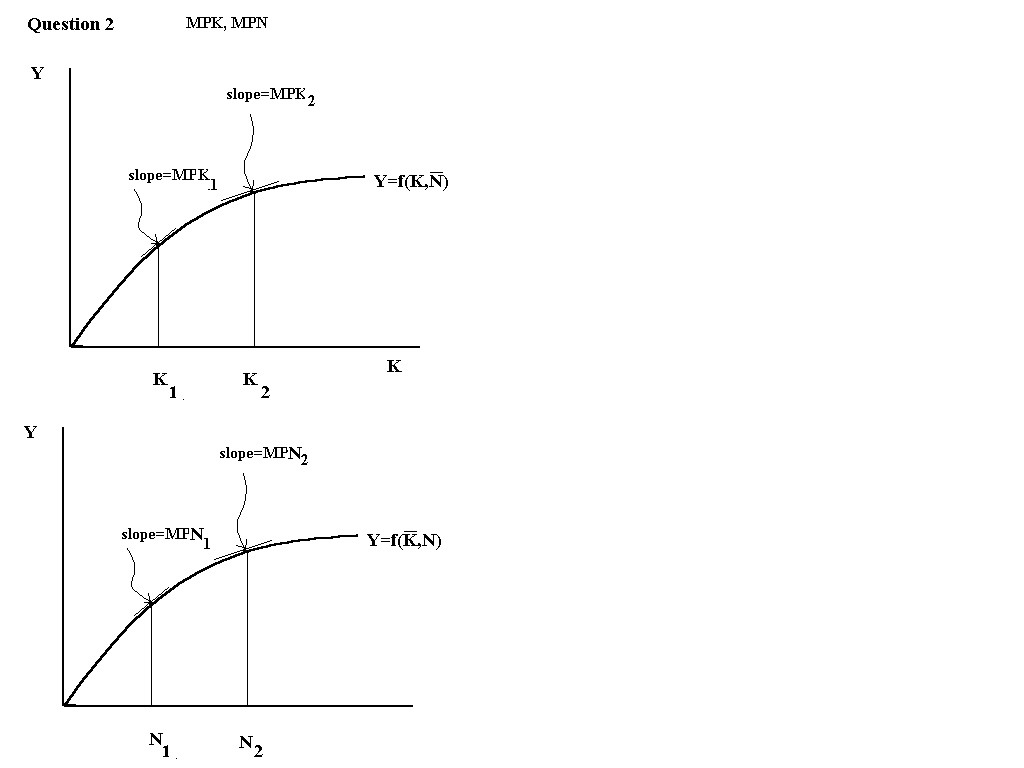

Q2. MPK is the increase in output from one unit increase in capital. In

other words, it is the slope of the line tangent to the production

function at any given K. Note: MPK decreases as K increases.

MPN is the increase in output resulting from one unit increase in labour

input. In other words, it is the slope of the line tangent to the

production function at any given N. Note: MPN decreases as N increases

a. Supposing the production function exhibits diminishing returns to

scale then two properties of the MPK function are: (1) MPK decreases as K

increases, (2) MPK is positive for all K.

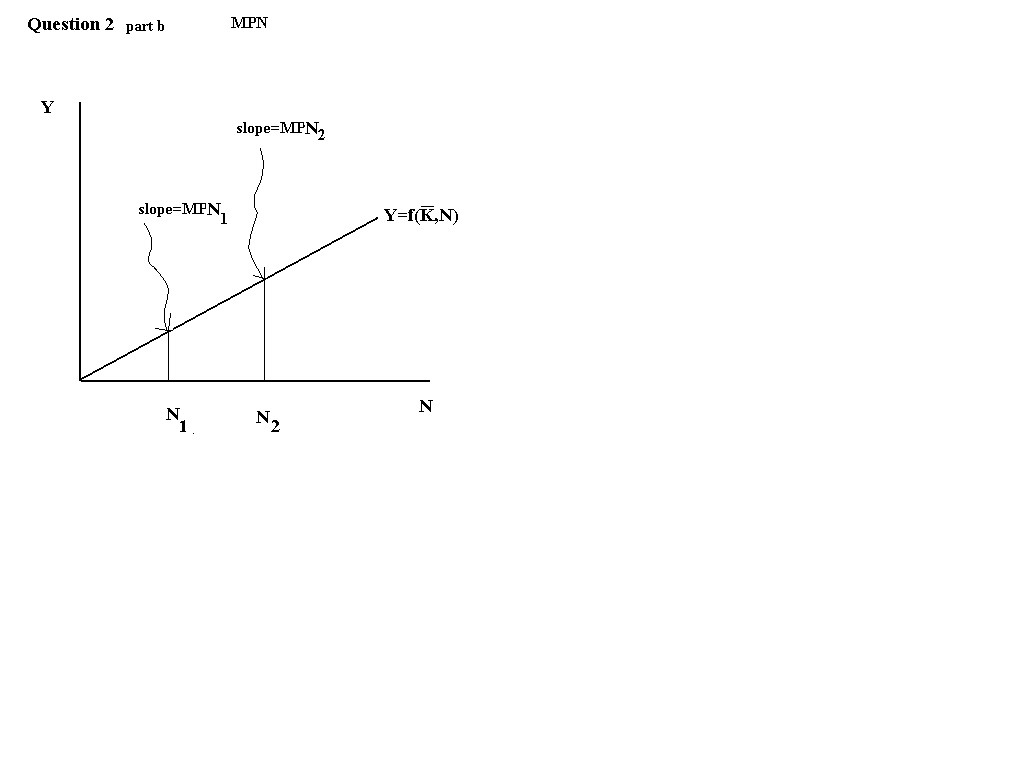

b. Supposing the production function exhibits constant returns to scale

(in N), then the properties of the MPN function are: (1) MPN remains

constant as N increases, (2) MPN is positive for all N

Q3.

a. Firms wish to set MPN=w and labour supply must equal labour demand

in equilibrium, so we can find N and w in the following manner:

Demand for labour is found where MPN=w

{other valid answers include: w=1500/[5+10(1-t)] or

w=300/[1+2(1-t)] }

b. when t increases we see that:

c. If t=0.5 then we can calculate w and N as follows:

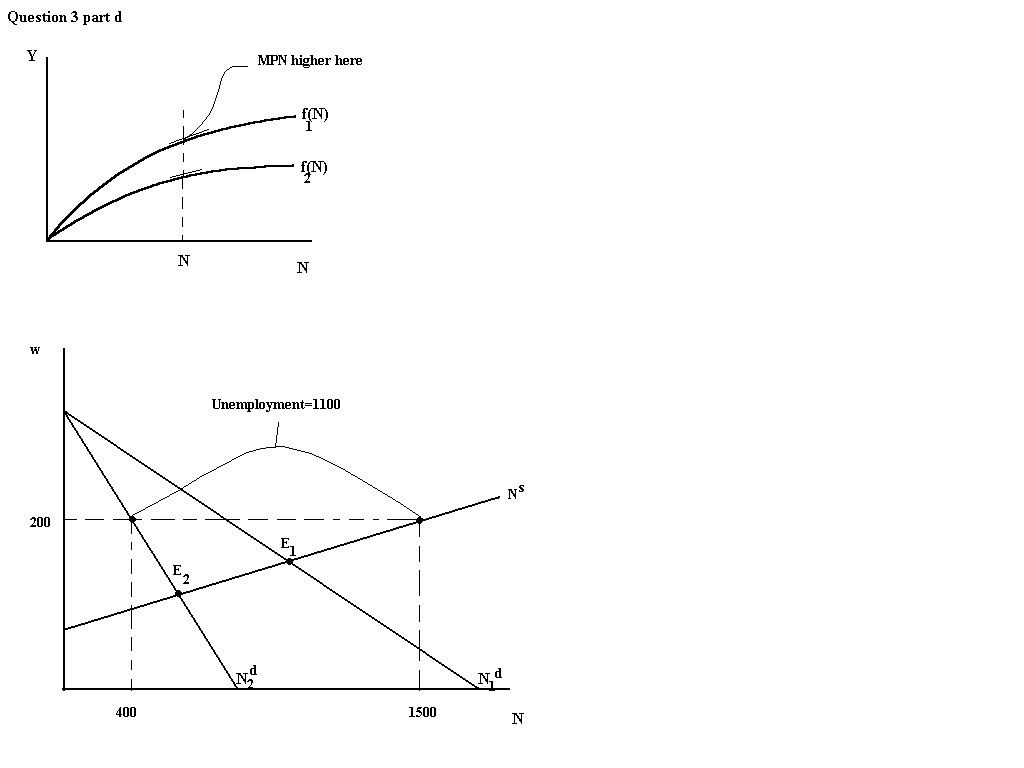

If a minimum wage is set at 200 employment will decrease and there will

exist involuntary unemployment:

Nd= 2000-5w = 2000-1000 = 1000

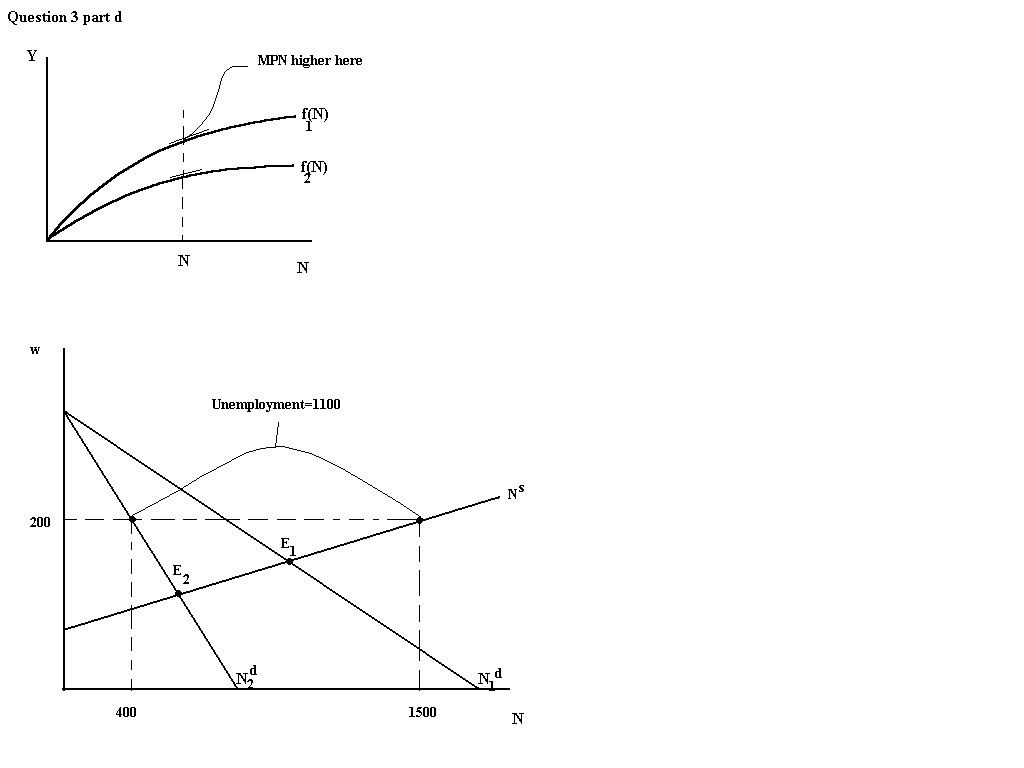

d. If a technological shock changes MPN to 400-0.5N we can see that at any

level of N the marginal productivity of labour is lower after this shock.

Thus, it is an adverse technological shock.

Now the firm will recalculate MPN=w to get a labour demand curve as

follows:

given the minimum wage of 200 this means that:

Q4

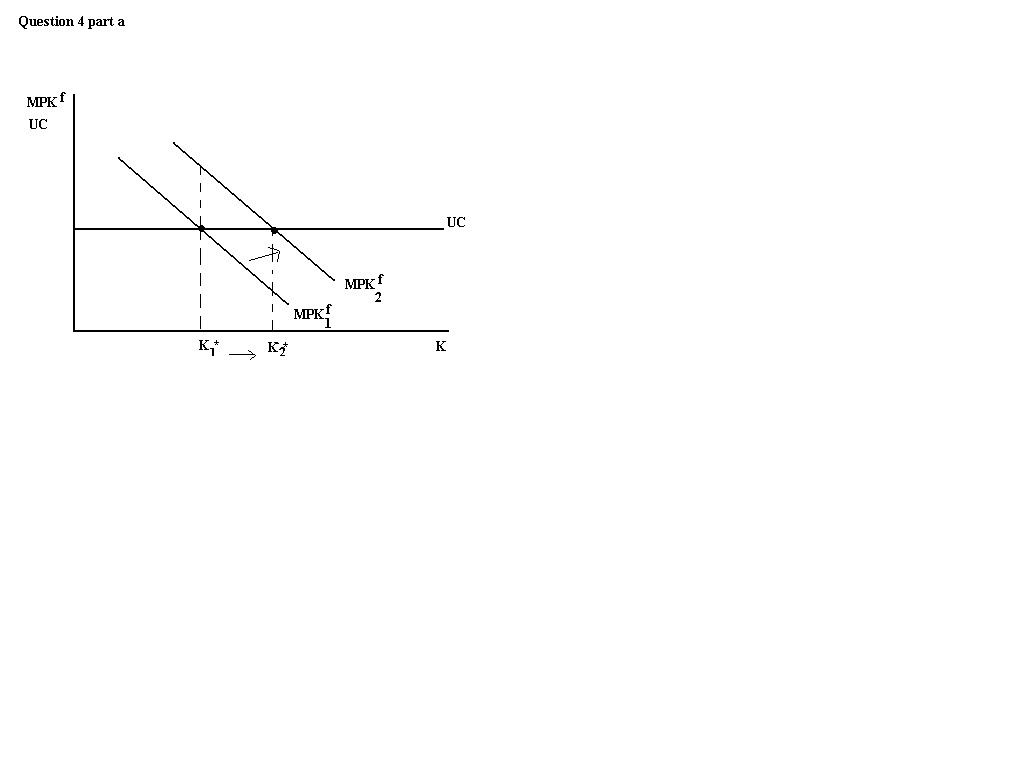

Desired capital stock is that amount of capital stock that allows a firm

to earn the highest amount of expected profit. Because a lag often occurs

in obtaining and installing new capital, firms compare the expected

future marginal product of capital MPKf with the user cost of

capital, where user cost of capital is the expected real cost of using a

unit of capital for one period. Firms maximize profit by buying capital

until MPKf = User Cost; that is, as long as the benefits

(MPKf) exceed the costs (User Cost) of purchasing one more unit

of capital, firms will purchase that unit, until such time as the benefits

exactly equal the costs. Graphically:

a. A technological improvement will increase MPKf for any given

K, but will not change the user cost of capital; therefore, a

technological improvement will increase the amount of capital stock

desired. Graphically:

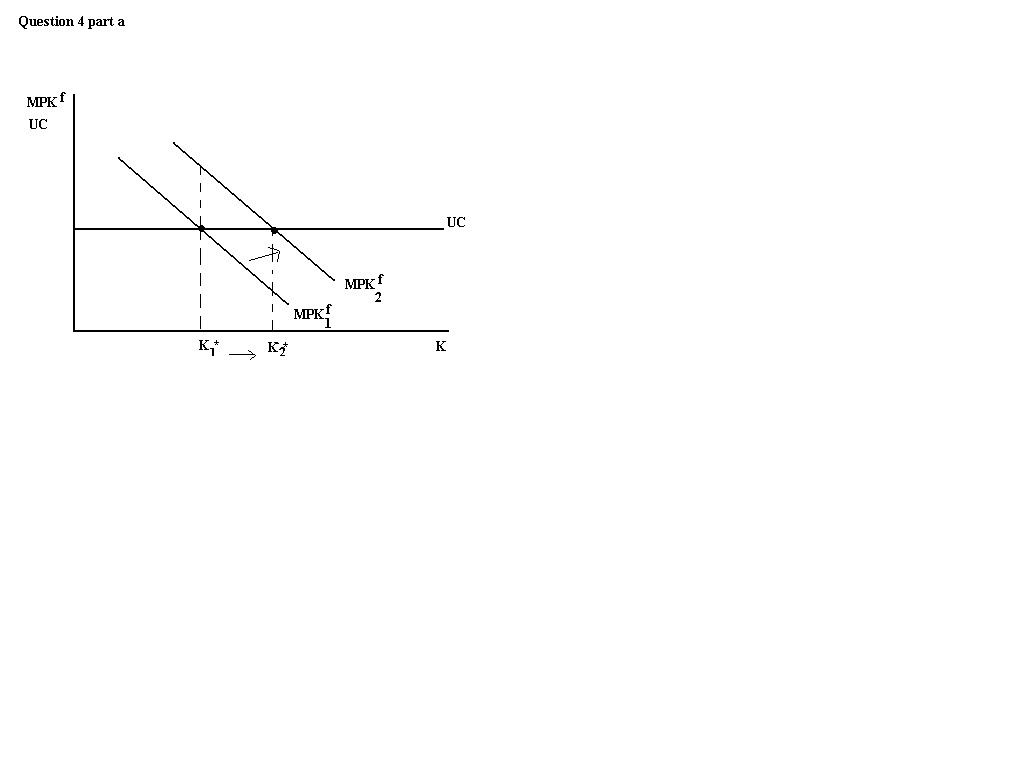

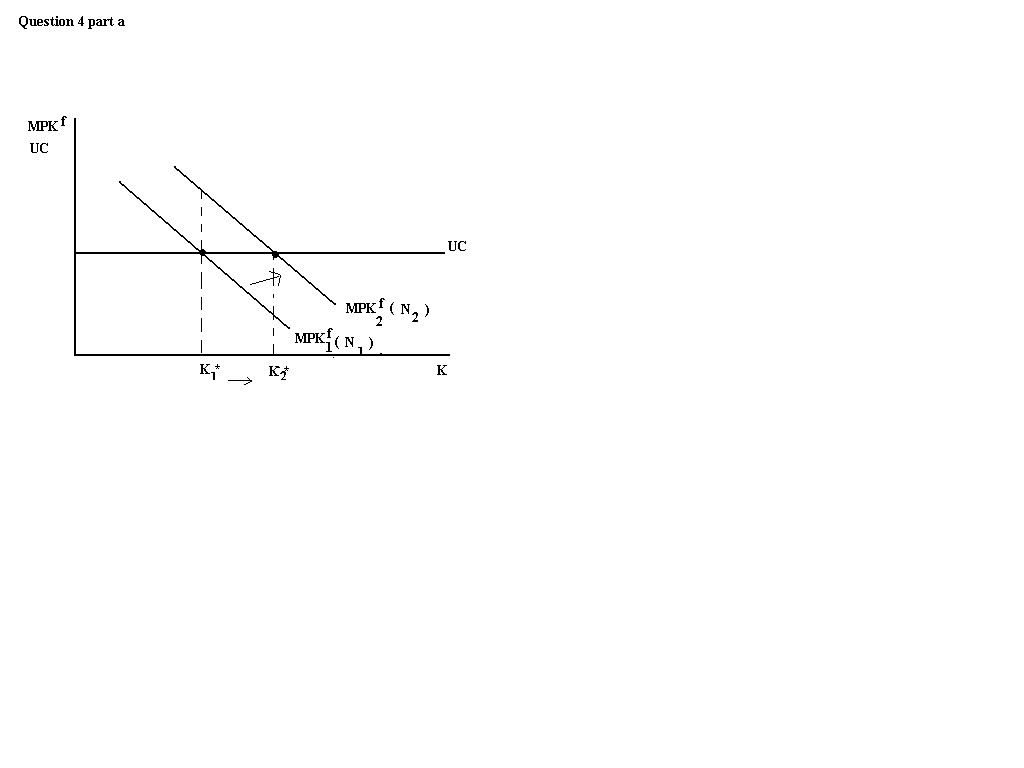

b. An increase in N due to increased immigration will increase

MPKf for any given K, but will not increase the user cost of

capital; therefore, an increase in immigration will increase the amount of

capital stock desired. (note: there was a typo in the

assignment, N was ommitted by accident so full marks are awarded where

this caused confusion) Graphically:

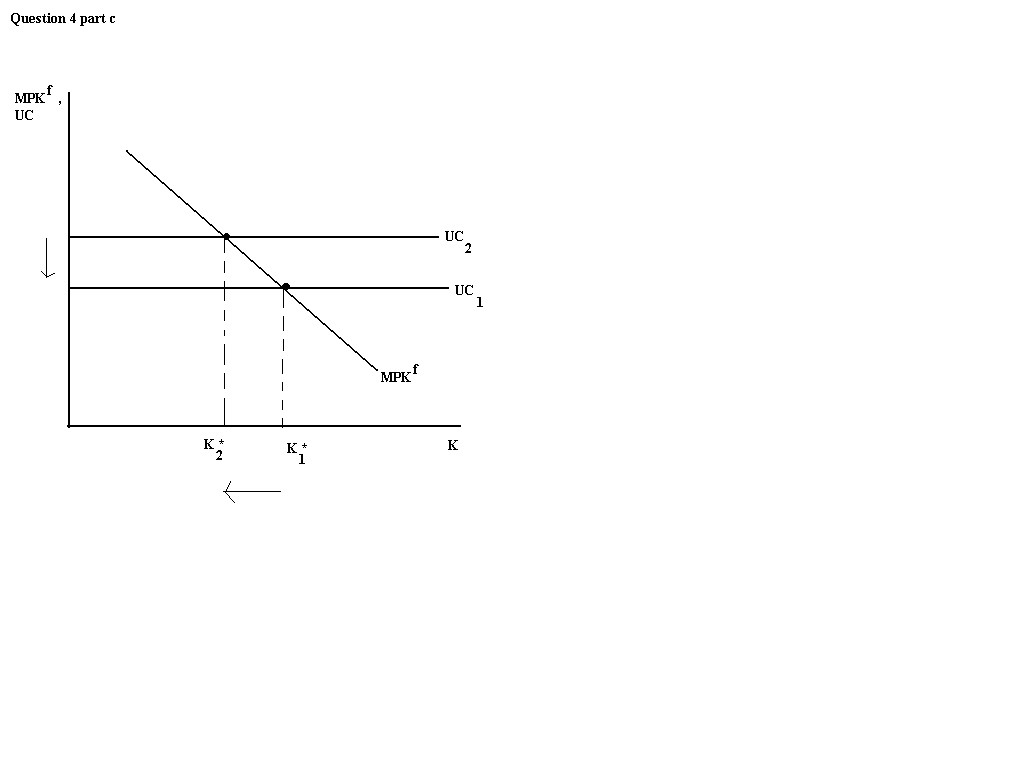

c. An increase in the real interest rate will increase the user cost of

capital. UC=Pk(d+r) where d=depreciation and r=expected real

interest rate.

Thus, an increase in r means and increase in UC. Therefore, an increase

in r will decrease the amount of capital stock desired.

Q5. Given current and future MPK=10000-2K+N, current and future

MPN=50-2N+K,Pk=$5000, r=0.1, d=0.15, and w=$15,

a.The user cost of capital is: UC

from (2)K=2N-35 sub this into (1) to get:

1250=10000-4N+70+N

so K = 2(2940)-35 = 5845

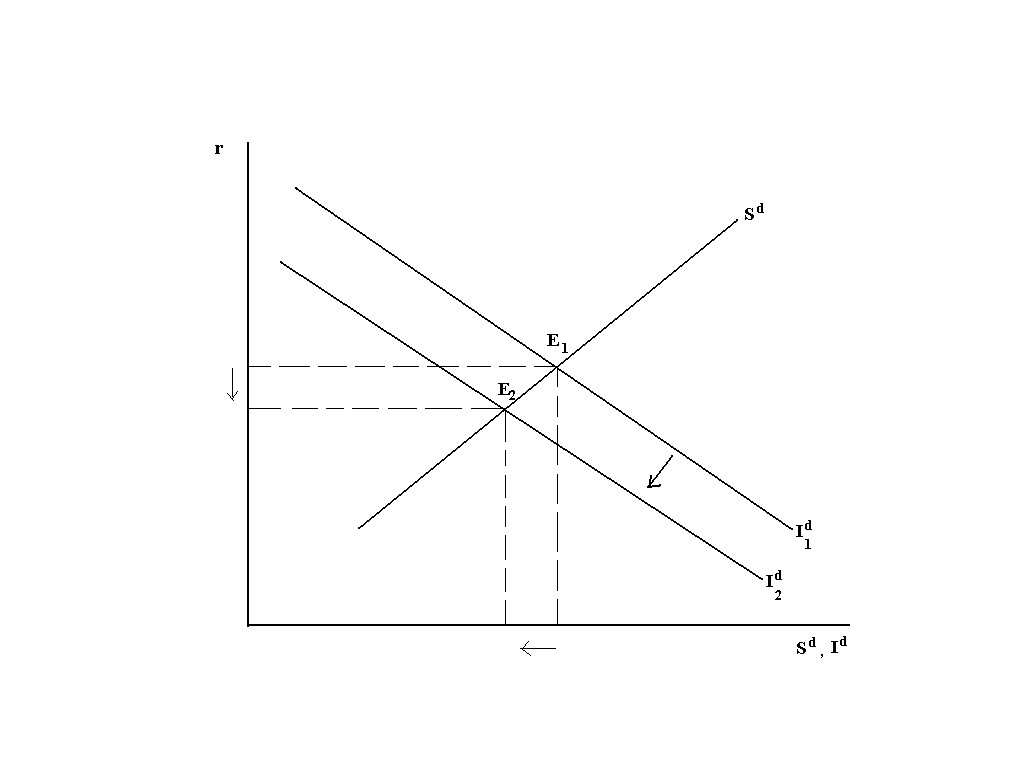

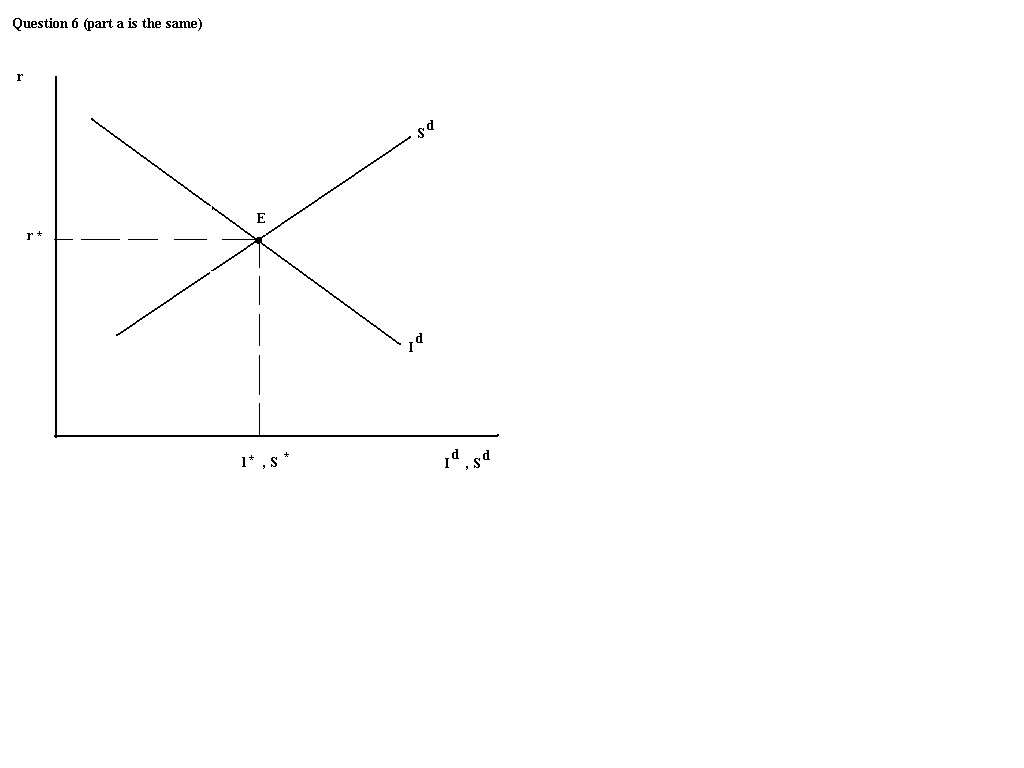

Q6. The equilibrium condition in the goods market is:

Graphically:

Note that: Id is downward sloping. This slope is because as r

increases the user cost of capital increases so the desired amount of

capital stock decreases and therefore Id decreases.

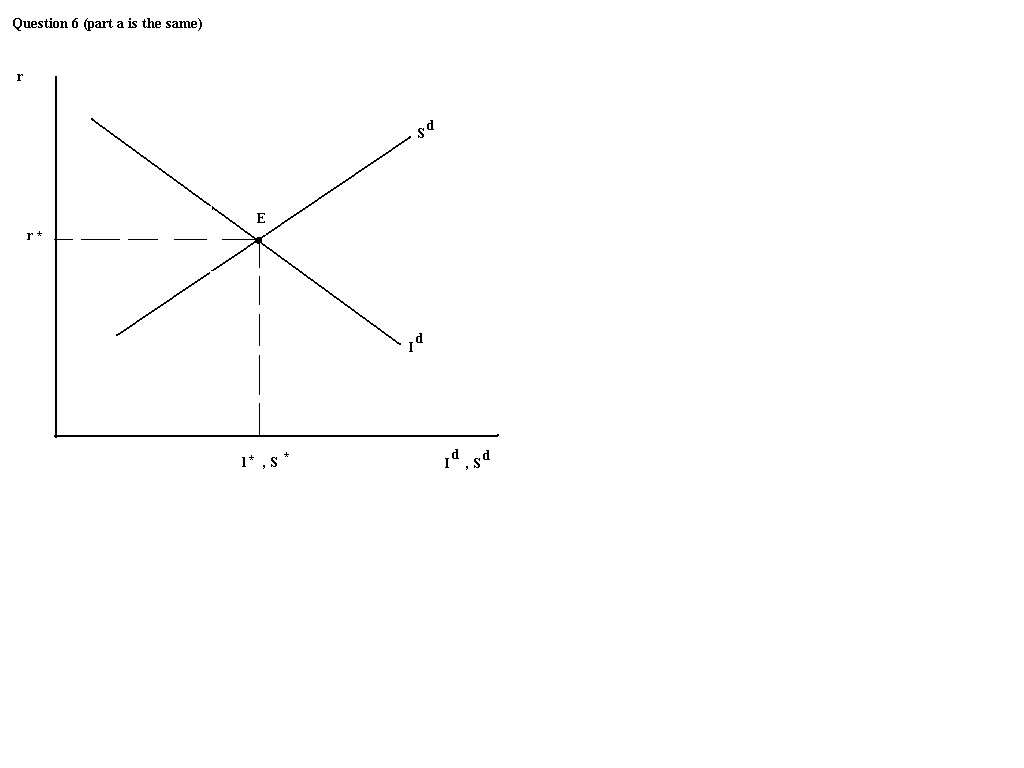

a. Ricardian equivalence implies that the timing of temporary tax changes

doesn't affect desired consumption or desired national savings. Thus, an

increase in the income tax rate will not shift Sd, nor will it

shift Id, and as such, there will be no change in the goods

marked equilibrium from and increased income tax rate.

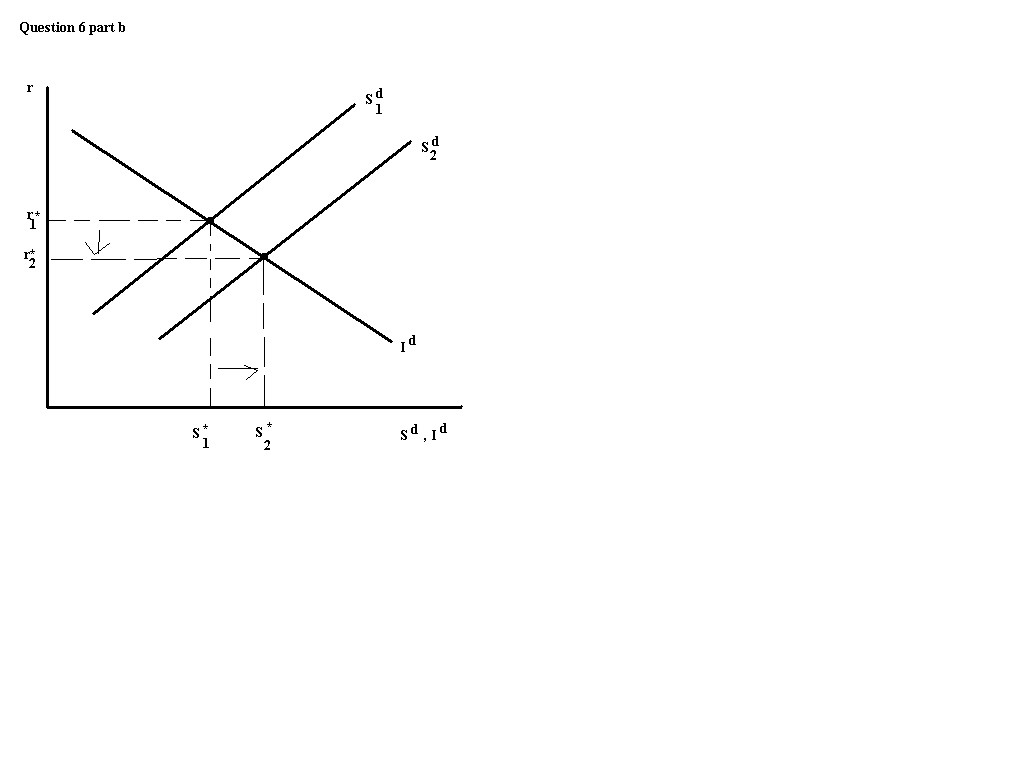

b. A temporary decrease in government spending will cause Sd to

shift right. Sd=Y-Cd-G, so for any given r, a

decrease in G implies that Sd is higher. The goods marked

equilibrium will shift right and down, yielding a lower equilibrium r and

a higher equilibrium Sd,Id.

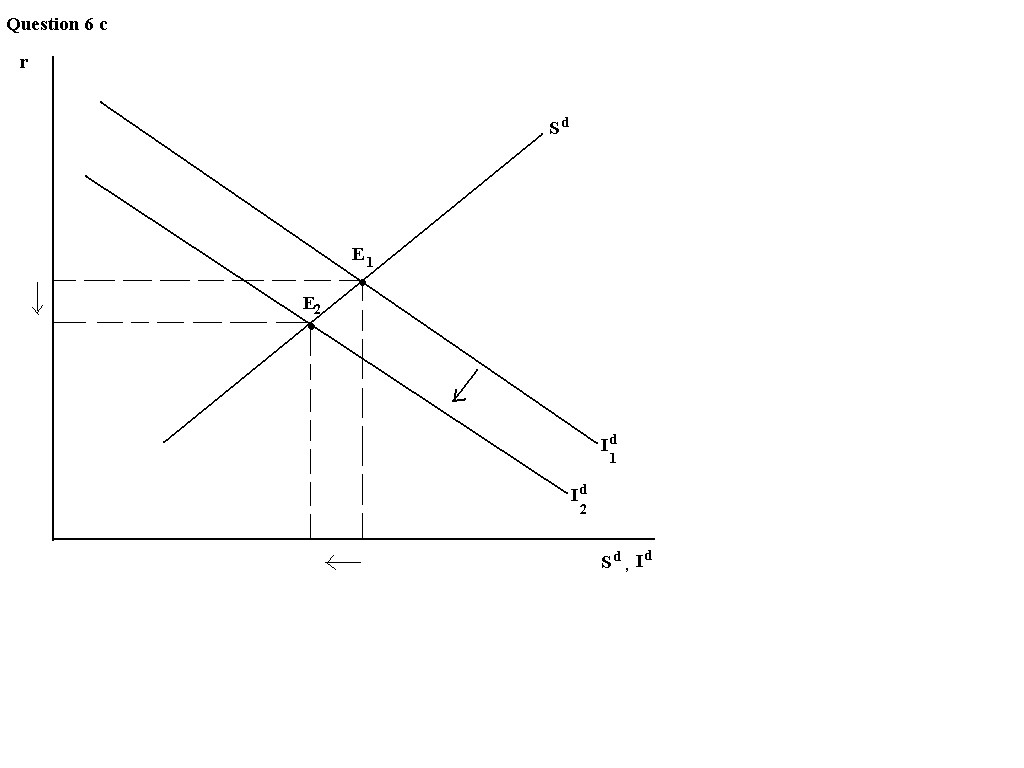

c. An increase in tax on a firm's revenue will increase the user cost of

capital:

(note: if you see τ in any of the above equations it means that your

browser does not support the current code. Wherever you see τ there

should be a lower case greek letter tau in its place.

Q7. Given full employment output = 5000, G=0,

Cd=3000-2000r+(0.1)Y, and Id=2000-4000r

a. The equilibrium values of r, Id, and Cd can be

found in the following manner:

Sd= Y-Cd-G = 5000-Cd-O

In equilibrium Sd=Id, so we have

Id= 2000-(4000)(0.083)= 1666.67

Cd= 3000-2000(0.083)+(0.1)(5000) = 3333.33

b. If government spending, G, increased from 0 to 1000 we can calculate

the new values of r, Cd and Id as follows:

Sd=Y-Cd-G

At equilibrium Sd=Id, so:

Id = 2000-(4000)(.25) = 1000

Cd = 3000-(2000)(.25)+500 = 3000

Intuitatively, as government spending incrases disposable income decreases

which causes savings to decrease, because savings decreases then at any

given r the amount desired to be saved will be lower, so in order to raise

the necessary capital for investment, for any level of investment, firms

will have to pay a higher r. At higher r the user cost of capital is

higher and firms will desire a lower amount of capital stock; hence

investment will be lower. Graphically

so 400-0.2N = w

so:

set supply=demand:

so N=2000-5(150/(1.5-t))

and w(1-t)=150(1-t)/(1.5-t)

(1.5-t) decreases so 150/(1.5-t) increases, in other words, w

increases.

Also, 2000-150/(1.5-t) decreases, so N decreases.

To see the effects on w(1-t) is more complicated. We determine the effect

on after tax wages by taking the derivative of w(1-t) with respect to t

and obtain:

This number is less than 0 for all t.

{Other valid answers include a

simple explanation of how increases in t will affect w(1-t), the

derivative method is not necessary}

So we see that an increase in t decreases after tax real wages.

Ns= 500+10(1-t)(w) = 500+1000 = 1500

So employment will be 1000 and 500 people will be involuntarily

unemployed.

Nd = 400/0.5 - w/0.5 = 800-2w

Nd = 800-400 = 400

but since Ns=1500 still, we have an increase in involuntary

unemployment resulting from the adverse technological shock coupled with a

minimum wage. Employment now is 400 and unemployment is 1100.

(1)UC=1250=10000-2K+N

(2) w=15=50-2N+K

so 3N=8820

Sd is upward sloping. This is because as

r increases the rewards to saving increases so people wish to save more (a

counter effect is that as r increases you need to save less in order to

earn the same amount in the future, but empirically it is shown that this

second effect is dominated by the first effect).

(1-τ)MPKf=(r+d)Pk

so MPKf=Pk(r+d)/(1-τ)

which increases as τ increases. Graphically: Thus Id is lower for any given r (the Id curve

shifts down) and the goods market equilibrium shifts down and to the left.

So the new equilibrium r is lower and the new equilibrium Sd,

Id are lower.

Thus Id is lower for any given r (the Id curve

shifts down) and the goods market equilibrium shifts down and to the left.

So the new equilibrium r is lower and the new equilibrium Sd,

Id are lower.

Sd= 5000-3000-2000r-(0.1)(5000) = 2000-4000r =

Id

r= 500/6000 = 0.083 or 8.3%

= 5000-3000+2000r-(0.1)(5000)-1000

= 500+2000r

500+2000r = -4000r +2000

6000r = 1500

so r = 0.25